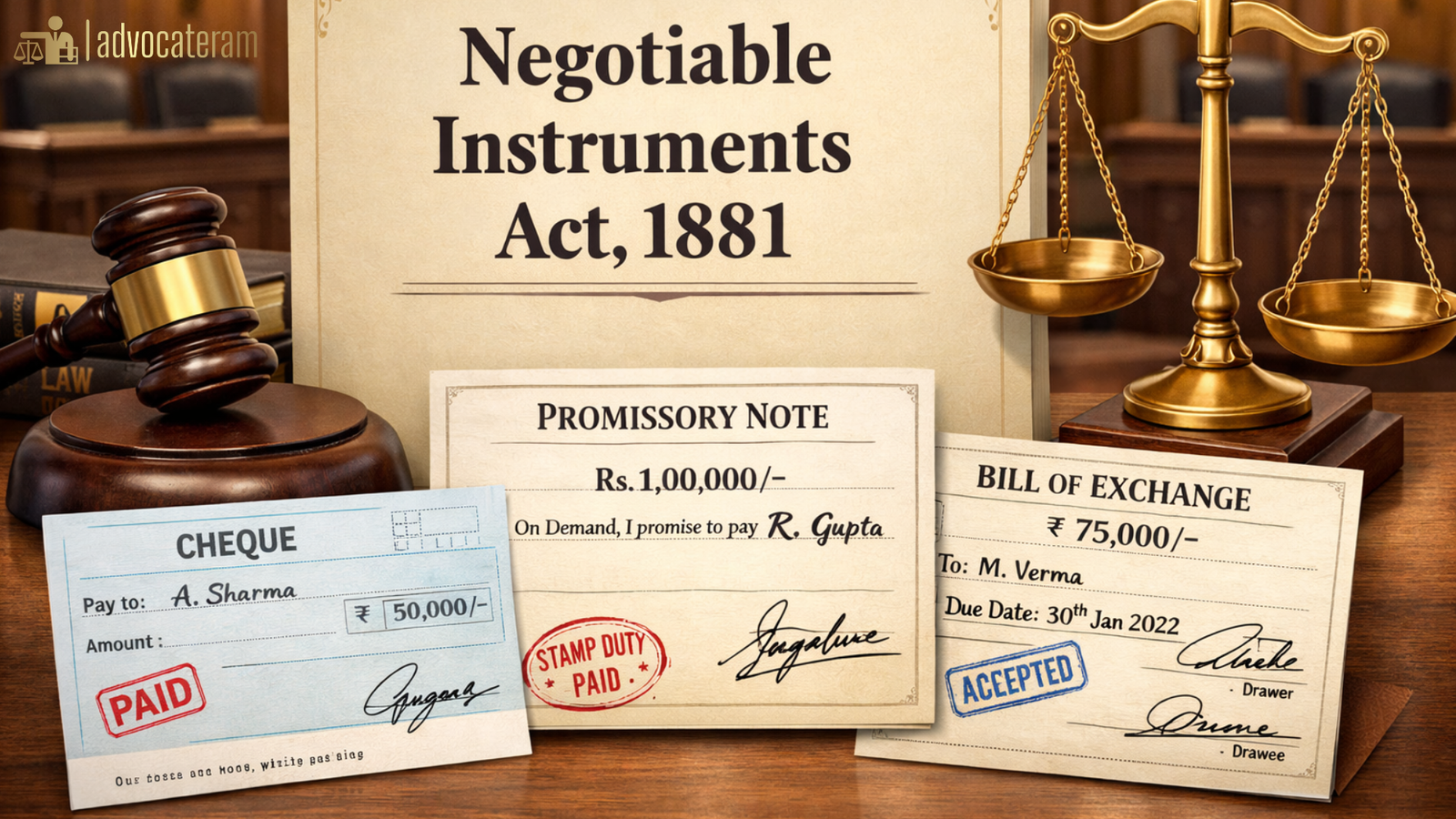

Definition of Cheque:

A cheque, under the Negotiable Instruments Act, 1881 (“NI Act”), constitutes a bill of exchange drawn upon a specified banker, payable exclusively on demand, encompassing both traditional instruments and modern variants such as the electronic image of a truncated cheque or a cheque in electronic form. This statutory delineation, enshrined in Section 6, underscores its pivotal role in commercial transactions as an unconditional order directing the drawee bank to remit a sum certain to the payee or bearer thereof. The ensuing exposition elucidates the definition, indispensable essentials, and manifold types of cheques, explicated in rigorous legal parlance consonant with the NI Act’s framework, cognizant of judicial precedents and legislative amendments thereto.

Definition Pursuant to NI Act:

Section 6 of the NI Act, 1881, furnishes the quintessence of a cheque thus: “A ‘cheque’ is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and it includes the electronic image of a truncated cheque and a cheque in the electronic form.” Explanation I thereto clarifies that a “cheque in the electronic form” denotes one generated via computer resource, authenticated by digital signature (inclusive of biometric or electronic variants) employing asymmetric cryptosystems, whilst Explanation II delineates a “truncated cheque” as that transmitted electronically sans its physical embodiment, subject to safeguards against alteration. This definition, engrafted by amendments vide the Negotiating Instruments (Amendment and Miscellaneous Provisions) Act, 2002, accommodates digital exigencies whilst retaining the instrument’s negotiability under Sections 13 and 14.

Judicially, the Supreme Court in B.S. Alu Factory v. Belapur Sugar & Allied Industries Ltd. (1992) affirmed that a cheque embodies an unconditional mandate, distinguishable from promissory notes or bills of exchange by its banker-drawee specificity and on-demand tenability. Absent expression of deferred payment, it remains payable forthwith upon presentment, per Section 3 thereof. The drawer incurs liability under Section 31, obliging the drawee bank, possessed of sufficient funds duly applicable, to honour the instrument; default precipitates compensatory redress. Presumptions under Section 118(a)-(g) and Section 139 fortify its validity, deeming due date, consideration, and discharge of enforceable debt unless rebutted by preponderance of probabilities.

Essentials of a Valid Cheque:

For a document to qualify as a cheque within NI Act ambit, it must satisfy sundry sine qua nons, deviation from which vitiates enforceability. Paramount is its constitution as a bill of exchange per Section 5, viz., an unconditional instrument in writing, addressed to the banker, containing an order to pay a sum certain in money on demand. Judicial scrutiny in R. v. Russell (pre-NI Act English precedent, adopted infra) mandates these constituents: writing, signature, unconditional order, drawee specificity, sum certainty, and demand payability.

- In Writing and Signed by Drawer: The instrument must manifest in tangible or electronic script, autographed by the account holder (drawer) with intent to bind. Forged or unauthorized signatures render it nugatory, per Section 10 proviso. Absence of signature equates to non est instrumentum.

- Unconditional Order to Pay: No contingency or condition precedent may qualify the payment directive; phrases like “subject to receipt of funds” invalidate it as a cheque, transforming it into a conditional bill. Section 5 predicates unconditionality.

- Drawn on Specified Banker: Exclusively upon a banking entity qua drawee; instruments drawn on non-bankers or individuals fail cheque status, per Section 6’s “specified banker” rubric. Post-dated cheques, whilst payable on demand post-date, retain validity sans constituting bills payable at fixed periods.

- Payable on Demand: Insuperable hallmark; non-demand stipulations disqualify it. Section 6 proscribes “otherwise than on demand,” rendering time-bills non-cheques. Presentment within validity (ordinarily six months per RBI, statutorily flexible) activates enforceability.

- Sum Certain in Money: Quantum must be determinate, expressible in figures and words; discrepancy resolves per Section 18, privileging words over numerals. Foreign currency equivalence suffices if convertible at presentment.

- Payee or Bearer Specificity: Payee must be ascertainable; bearer cheques nominate “bearer” or omit payee, whilst order cheques specify named payee. Section 7 and 8 govern holder rights.

Supplementary requisites include certainty of date (ante-dated permissible, undated voidable), proper stamping (negligible for cheques under Indian Stamp Act), and absence of material alterations vitiating under Section 87. Truncated or electronic variants demand fidelity to physical counterparts, per Section 6 Explanation II. Non-compliance attenuates presumptions under Section 118, exposing to dishonour liabilities under Section 138.

Types of Cheques:

The NI Act, whilst not exhaustively classifying cheques, accommodates typologies derivable from form, crossing, payee designation, and function, each imbued with distinct legal sequelae. These variants facilitate nuanced commercial utility, fortified by Sections 123-131A on crossing and holder protections.

Bearer and Order Cheques

- Bearer Cheque: Nominates “bearer” or bears omission of payee, payable to holder per Section 8. Negotiable by mere delivery; theft or loss hazards title defects, unabetted by Section 123 crossing. High fluidity, yet Section 85(1) safeguards banks paying good faith holders.

- Order Cheque: Endorses named payee sans crossing, transferable by Section 48 endorsement and delivery. Payee’s indorsement vests title in endorsee; “account payee” sans crossing remains order variant.

Crossed Cheques:

Section 123 bifurcates: General Crossing (two parallel lines, optionally “and Co.”) mandates deposit-credit to payee’s account, insulating against cash payment. Special Crossing appends bank name, confining collection to that bank or agent. Overcrossing (“not negotiable”) per Section 130 nullifies value-assumption by transferees; “account payee” (restrictive, post-2002 amendment) non-negotiable, creditable solely to payee’s account, per RBI circulars engrafted statutorily. Banks incur no Section 128 liability if paying per crossing bona fide.

Electronic and Truncated Cheques:

Post-2002, Section 6 embraces Electronic Cheques (digitally signed, per IT Act, 2000) and Truncated Cheques (electronically imaged, physical retained by drawer). Both inherit traditional liabilities; Section 89 indemnifies banks honoring apparent regulars sans original.

Post-Dated and Stale Cheques:

Post-Dated Cheques (future date) constitute valid bills payable on demand post-date, actionable under Section 138 if dishonoured post-maturity. Stale Cheques (unpresented beyond banking validity, typically 3-6 months) lose presumptive regularity, though not statutorily void.

Other Functional Variants:

- Self Cheque: Drawer-payee identical; endorsable or cashable personally.

- Traveller’s Cheque: Prepaid bearer instruments, akin cheques but issuer-funded, outside pure NI Act purview.

- Banker’s Cheque/Demand Draft: Bank-issued, irrevocable per RBI, quasi-cheques sans drawer account linkage.

| Type | Key Feature | NI Act Reference | Legal Effect |

| Bearer | Payable to holder | Sections 8, 85(1) | Negotiable by delivery; bank protected |

| Order | Payee named, endorsable | Section 48 | Transfer by indorsement |

| Generally Crossed | Two lines | Section 123 | Account deposit only |

| Specially Crossed | Bank named | Section 124 | Specific bank collection |

| Account Payee | Restrictive crossing | Section 123 proviso | Non-transferable |

| Electronic/Truncated | Digital/ imaged | Section 6 Expl. I-II | Equivalent to physical |

| Post-Dated | Future date | Judicially valid | Demand post-date |

Legal Implications and Dishonour:

Dishonour attracts Section 138 criminality if for insufficiency, Account Closed, Payment stopped by Drawer, with 15-day notice and 30-day pay failure. The Implication under NI Act, 1881 is upto Two Years imprisonment or double the amount of Cheque or both.